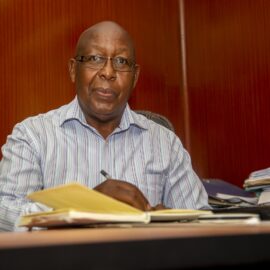

Jack Ngoma

CEO

Data as of 31 December 2024. For latest data please see quarterly operations reports.

Mobile money services were adopted in 2017 where a pilot was launched for clients in the Chipata and Petauke branches. Since then, mobile money technology has been implemented across all branches and 100% of disbursements and 60-70% of repayments are now electronic. Reducing cash handling improves the efficiency of operations and makes it safer and easier for clients to run their business and access and repay loans.

Read Bio

CEO

Read Bio

CFO

Read Bio

Operations Manager

Read Bio

HR Manager

Read Bio

Chairperson and Group CEO

Read Bio

Director

Read Bio

Director

Read Bio

Director

Read Bio

Director

Read Bio

Director

Read Bio

Director

Malawi, Zambia and Zimbabwe are among the countries in sub-Saharan Africa most affected by the severe impacts of the El Niño induced drought which is having catastrophic consequences including failed harvests, lack of food supplies and malnutrition. All three countries… Read more

Read moreCEO

Jack has the overall responsibility for implementing the strategic business plan of the organisation, developing new partnerships and developing the team. Qualified as a Chartered Accountant, Jack comes with several years of financial management and microfinance experience, having previously worked at Bayport Financial Services as the interim Head of Finance for MLF Malawi, and as MLF Zambia’s CFO from 2014 until September 2018, when he was promoted to his current position of CEO. Since he took over as CEO, MLF Zambia has witnessed significant growth in both client numbers and loan portfolio.

CFO

Bornface is responsible for the development and implementation of an effective financial management framework, including the designing of the financial policy, identifying and managing financial risks and representing the company to investors, auditors and the regulator.

Qualified as a Chartered Accountant, Bornface has previously worked at MultiChoice Zambia Limited and MTN Zambia. He comes with extensive experience in financial reporting and analysis, risk management and project management.

Operations Manager

Titus Zulu is a Microfinance expert with over 16 years of experience in the Non-Banking Financial Institutions in Credit and Operations department with profound experience in Credit Management, Debt Collection Management, Operational Planning, Project Planning Management and Humanitarian Emergency Affairs.

Titus has previously worked for both private and NGO sectors: VisionFund Zambia Ltd as The Operations Manager, Pulse Financial Services Ltd as a Referral Networking Officer and in non-governmental organisations; World Vision Zambia as a Field Operations Coordinator and at Caritas Czech Republic as a Field Offices Coordinator.

He holds a Masters in Project Planning Management from the Information and Communications University, a Bachelor’s of Science Degree in Banking & Finance with a Merit obtained from the University of Lusaka and a Diploma in Finance and Accounting from The University of Zambia. He is an alumni of School of Africa Microfinance (SAM) a 2015 intake in Kenya. In 2023 Titus also completed Inspiring Development's Chief Risk Officer (CRO) Circle Scholarship Program with the Symbiotics Association for sustainable Development.

HR Manager

Monde is a Human Resource practitioner with over 14 years hands on experience in labour relations, collective bargaining, employee engagement, training and development. She is responsible for all HR systems and procedure, employee engagement, recruitment and selection, training and development, performance management conflict resolution and compensation.

Monde has previously worked for British American Tobacco Zambia Plc, VisionFund Zambia, Micro Bankers Trust, Prosoft Human Resource, and Career Prospect Ltd and has extensive experience in employee relations, employee engagement, HR policy design and implementation, Union negotiations, immigration, performance management, training and development.

Monde is currently studying an MBA in Organisational Leadership at University of Zambia, holds a Degree in Human Resource Management from Mulungushi University & a Diploma in Human Resource Management from Evelyn Hone College.

Chairperson and Group CEO

Chairperson for Zambia, Group Chief Executive Officer and Director on the Board for Malawi and Zimbabwe

Medha Wilson is the Chief Executive Officer at MicroLoan Foundation. In her current role she oversees the activities of MicroLoan’s operations in Africa and is responsible for developing the overall strategy of the Group. She serves on the board of the three MicroLoan subsidiaries in Malawi, Zambia, and Zimbabwe, and is Chairperson in Zambia.

Medha has extensive experience in financial inclusion in both senior operational and investment management roles in emerging and frontier markets, across Asia and Sub-Saharan Africa. Her expertise also includes establishing and scaling-up of greenfield operations, turnaround of struggling entities and governance. She also has considerable experience in engaging with a broad range of social and impact investors.

Medha is a Qualified Chartered Accountant and holds a degree in Econometrics and Mathematical Economics from The London School of Economics.

Director

Regional Director and Chief Executive Officer Zimbabwe, Board of Directors Zambia

Mateo Zanetic is the Regional Director of MicroLoan Foundation. In his current role he is responsible for operations management, which includes providing hands-on support to MLF CEOs in Malawi, Zambia and Zimbabwe. Mateo serves on all three MLF subsidiaries. His responsibilities include providing guidance and troubleshooting in areas related to expansion to new operational areas and products, development of annual budgets and setting of performance targets for operational staff. Mateo heads the Social Performance Management function and is responsible for developing the evolving SPM framework and the reporting of SPM findings to both internal and external stakeholders. Currently, Mateo also serves as a CEO of MLF Zimbabwe.

Mateo has an extensive background in microfinance operations in Southern Africa, specifically in scale-up of activities, integrating social performance in operational decision-making and in people management.

He holds a degree in Management Accounting and Corporate Finance from Wits University.

Director

Alexander Muyovwe is presently Managing Partner of Muyovwe & Co Chartered Accountants is a Fellow of Chartered Association of Certified Accountants – UK and a Fellow of Zambia Institute of Chartered Accountants. He previously operated also under the name AUDICO Associates Chartered Accountants of Zambia. He has over 40 years post qualification experience in various entities among them copper mines, construction companies and varied trading and training institutions in various sectors of the Zambian economy.

He has boardroom experience in tertiary educational institutions having sat on the Copperbelt University Council for over eight years and six years on the Board of the Zambia Cooperative Federation. He is also currently serving on the board of PANOS Southern Africa and chairs the finance and audit committee of the Board, the Council of St John Zambia and is the Council Treasurer.

Director

Michael is an Economist-turned School Technology Leader with over a decade of experience keeping schools at the leading edge of technological innovations. He is passionate about what technology can do for education and is determined to discover creative ways to assist schools and organisations to exceed in their learning and productivity goals.

Michael holds a degree in Economics from the University of Hull and a Masters in Development Economics from the School of Oriental and African Studies.

Director

Mirriam Banda is the Co-founder and Director of Eton Consultancy Ltd., a human resource service provider dedicated to helping companies realise their potential by developing efficient practices in recruiting, training and development, and employee relations. She believes in incorporating creative leadership skills to achieve business objectives.

Mirriam is an active member of the Zambia Institute for Human Resource Management and has over 35 years of work experience in Human Resource Management and Administration. This includes 18 years of experience working in the healthcare sector. She has worked in various other business sectors, namely manufacturing, transportation, hospitality and international corporate organisations. Most recently, she served as the Director of Human Resources and Administration at cfb Medical Centre for 6 years before returning to entrepreneurship and founding Eton.

Director

Andrew Bamugye is currently the Senior Investment Manager at the Trade and Development Fund of the Trade and Development Bank Group where is charged with driving the SME investment business of the fund across Eastern and Southern Africa. The fund invests between USD 0.5 million to 10 million.

He has over 21 years’ experience working across sub-Saharan Africa supporting growth oriented SMEs with growth capacity and finance having worked with the UNDP/IFC’s African Management and Services Company across the region. Andrew sits on the boards of Kutlwelo group of South Africa, an emerging energy business as well as Uganda Funeral Services group of Uganda and is an executive committee leader at the Uganda Diaspora in Agribusiness Network.

Director

Chibuta Mumba is presently Country Head of Advisory Services at Nolands in Zambia.

He is a seasoned profession with vast international experience having worked in many countries including South Africa, Nigeria, Liberia, Ghana, Zimbabwe, DRC and Zambia.

He is a member of the Institute of Internal Auditors and past member of the South African Institute of Professional Accountants.

He has boardroom experience in both South Africa and Zambia.

He has previously held positions of Group Finance Director (South Africa and Zambia), Finance Director, CFO, Head of Accounting & Finance and CEO of different sizeable entities, few of which are listed.

Whilst he has vast past experience in Finance, Accounting, Audit, Tax and General Consulting, his current area of expertise is Internal Audit, Risk Management, Corporate Governance Services and Training.

He is also involved in community work having previously served as youth director and currently as chair of the Men’s group at the local church that he attends.