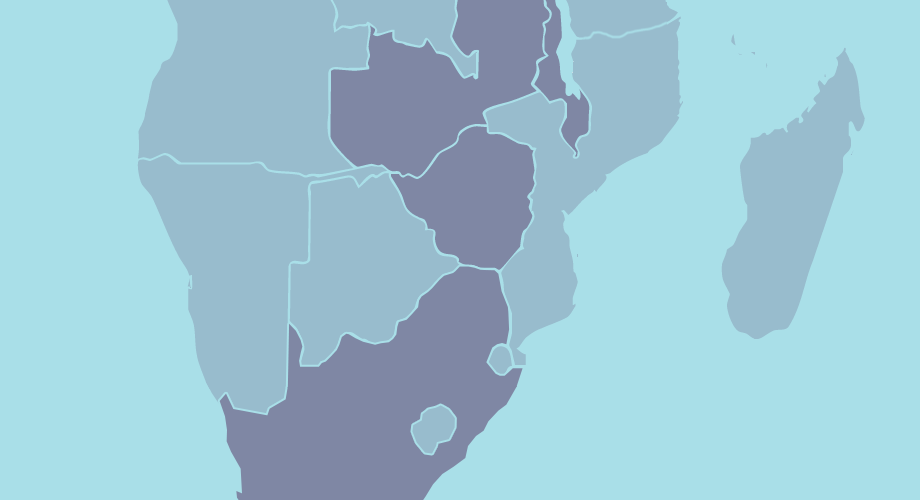

In Malawi, Zambia, Zimbabwe and South Africa, many women are held back from engaging in economic life. They are less likely to get an education, and many women are married at a young age to relieve the financial burden on their parents. Cultural norms and legal structures, such as inheritance and land ownership rights, reinforce inequality and hamper women’s economic empowerment.

Empowering women has positive repercussions for everyone in the community. Research shows that women are much more altruistic with their incomes. According to World Bank, women reinvest 90% of every dollar that they earn back into their families’ education, health and nutrition. This means that by supporting women, we improve access to nutritious food, healthcare and education for children and dependants too.

What’s more, women are more likely to repay their loans. There is a wealth of research to prove this. When loans are repaid to MicroLoan, they can be used again and again to support more women to feed their families. This means that by supporting women, our reach is wider, and our impact is greater.